The forex trading landscape in India has seen a significant shift in 2025 due to heightened regulatory scrutiny. One of the biggest changes came when Exness, a major global forex broker, halted new client registrations from India on July 11, 2025.

This blog explains the reasons behind this move, what it means for existing Indian traders using Exness, relevant risks, and some recommended alternatives like WinProFX. Also included are key FAQs to address common trader concerns.

When and Why Did Exness Stop New Registrations in India?

The sharp regulatory tightening by the Securities and Exchange Board of India (SEBI) and enforcement of Reserve Bank of India (RBI) guidelines around forex trading prompted Exness to pause new Indian client onboarding. The primary trigger was the introduction of a mandatory UPI (Unified Payments Interface) payment verification system for licensed brokers, intended to curb unregulated offshore forex participation and safeguard retail investors.

Exness, being an offshore broker not registered with SEBI or RBI, fell out of compliance. Since trading foreign exchange currency pairs other than those involving the Indian Rupee (INR) is restricted under India’s Foreign Exchange Management Act (FEMA), Exness stopped accepting new client registrations from India to align with legal imperatives and reduce regulatory risk.

This regulatory environment makes India’s forex market challenging for many international brokers who fail to acquire the necessary licensing, as explained in detail by WikiFX, Finance Magnates, and Aseem Juneja’s analysis.

What Does This Mean for Existing Exness Users in India?

If you are an existing Exness user in India, you can still operate your current account and trade, but there are some important considerations:

- You retain access to your funds and trading features for now.

- Exness operates without Indian regulatory approval, placing you in a legal grey zone.

- Withdrawal processes and bank transfer approvals might experience delays or extra scrutiny.

- There is no recourse under Indian financial consumer protections if disputes arise.

- Regulatory risk remains, so stay updated on official announcements and prudently manage your trading.

In summary, continued use of Exness involves potential legal and banking risks unique to Indian residents, and you should evaluate these carefully before continuation, as detailed in analyses by Blacksuit and Aseem Juneja.

Recommended Alternative: WinProFX for Indian Traders

To mitigate risks and enjoy smoother compliance, consider WinProFX, a broker that supports Indian investors with:

- Convenient UPI deposit and withdrawal methods suitable for Indian banking.

- Full Know Your Customer (KYC) verification to comply with anti-money laundering regulations.

- Regulated status or compliance-friendly policies for Indian clients.

- Competitive trading conditions and a strong focus on the Indian retail market.

For detailed comparisons and other compliant brokers, visit the comprehensive guide Best Forex Trading Platforms in India and explore trusted options like WinProFX, which is recognized for its UPI-enabled deposits, withdrawal safety, and India-focused service.

Key Points Indian Traders Should Keep in Mind

- Exness is not authorized or regulated by SEBI or RBI and hence poses legal risks in India.

- Indian forex rules prohibit trading of non-INR pairs through unlicensed foreign brokers.

- Banking transactions related to offshore brokers may be flagged or blocked.

- Utilize brokers with UPI integration and verified KYC like WinProFX for safer trading.

- Always keep abreast of regulatory developments and practice strong risk management.

Frequently Asked Questions (FAQs)

Is Exness legal to use in India?

No. Exness lacks Indian regulatory approval and operates offshore, meaning it carries legal and financial risk for Indian users.

When did Exness stop accepting new Indian clients?

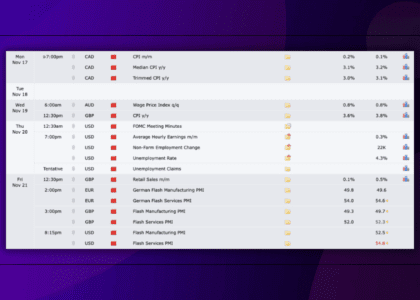

On July 11, 2025, in response to India’s UPI verification policies and regulatory pressure.

Can existing Indian accounts on Exness continue to trade?

Yes, but with risks pertaining to banking, regulatory enforcement, and fund withdrawal delays.

What is a reliable alternative to Exness?

WinProFX, which supports UPI payments and complies with Indian regulatory standards.

How can I make deposits and withdrawals safely in forex trading from India?

Use platforms that support UPI transactions and adhere to KYC requirements.

Final Thoughts

The Exness India update reflects a significant regulatory tightening in 2025. Indian traders should carefully evaluate the legal and financial risks of offshore platforms and consider verified, India-focused alternatives to continue trading with confidence. Staying informed and compliant is the best approach in the rapidly evolving Indian forex market.

For a comprehensive list of alternatives and forex trading guides for India, visit: Best Forex Trading Platforms in India.